Crypto arbitrage is one of the easiest methods to make money in the crypto markets. However, it can also be one of the most difficult, without the right technology.

Crypto arbitrage entails buying crypto coins on one exchange, and selling them at another for a higher price. However, one needs the right technology to identify opportunities for arbitrage, and execute them. These opportunities are milliseconds long. Not only does none need to identify them, they need to predict them.

One of the best ways to predict arbitrage opportunities is via machine learning and AI. It ensures that one is able to exploit every possible opportunity to turn a profit.

How to Use MOSDEX

Sign Up for a Mosdex Account

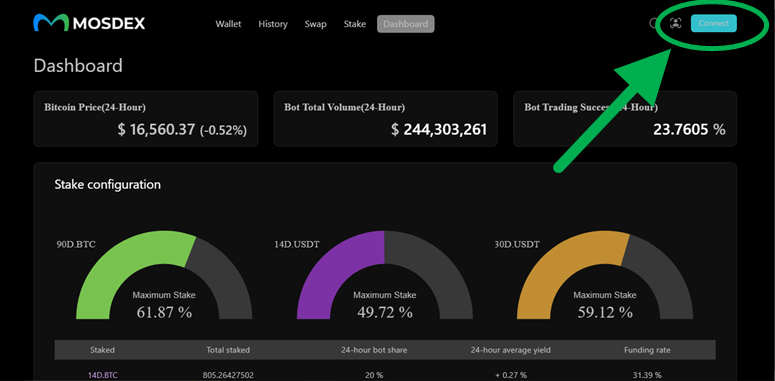

To use the Mosdex platform, you will need to create an account. The first step is to visit the Mosdex homepage.

On the homepage, click on the blue Connect button on the top right corner.

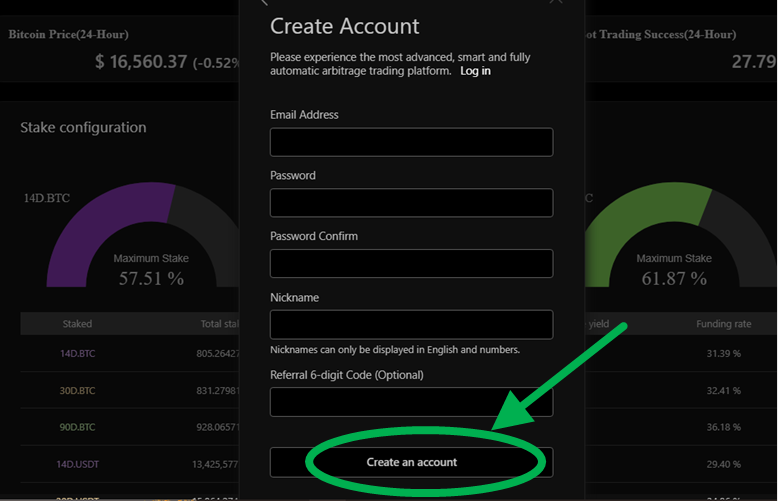

In the popup window, fill in your details in the fields provided, and click on the ‘Create Account’ button.

Once you have an account, visit the wallet tab to deposit funds.

Mosdex accepts deposits in BTC or USDT. Once you click ‘deposit’, you will see a wallet address and a QR code. Scan the QR code or enter the wallet address directly to deposit funds. With the funds in your account, you can begin arbitrage trading on Mosdex.

You can now click on the Stake Button once the funds are in your account. You will also have to select the lock-up period of 14, 30, or 90 days. The longer the lock-up period, the more ROI you will make.

Mosdex Engine Makes Arbitrage Profitable

Due to advancements in crypto trading, arbitrage is becoming less profitable. Without the right engine, identifying the right opportunities is almost impossible.

Arbitrage is proving that with proper technology, making money from arbitrage trading is possible. The fintech firm, which is based in Finland, has the goal of helping crypto traders take advantage of all crypto arbitrage opportunities.

Mosdex stands out from other arbitrage solutions for its use of AI, Machine Learning, and a proprietary trading engine. The powerful matching engine that drives the Mosdex platform works to quickly discover all arbitrage opportunities and execute trades. With the aid of DeFi, smart contracts, AI, and Machine Learning, users are guaranteed of profits, no matter the market conditions.

How Arbitrage Works on Mosdex

Mosdex utilizes various arbitrage solutions to maximize profits for its users. The arbitrage solutions used on Mosdex are as follows:

Cross-Exchange Arbitrage

With this solution, users buy assets on one platform and sell them on another, taking advantage of the price difference to turn a profit. To maximize profits, Mosdex incorporates AI to detect price differences amongst exchanges and execute trades in milliseconds. The result is that even in the highly volatile crypto markets, traders can still make profits.

On Mosdex, this is the most basic method of arbitrage. It is designed to allow even small-scale traders to profit where traditionally, only high-net-worth traders would profit. A user does not need complex setups and a deep understanding of the markets to succeed. All they need is to stake on Mosdex, and the arbitrage is executed automatically.

Triangular Exchange

This arbitrage entails using three different crypto coins and trading their price differences on one exchange. Doing so eliminates the cross-exchange fee, which increases the overall profit margins. Let us use the example of BTC, ETH, and XRP to understand how it works. To use this feature, the Mosdex protocol will sell BTC for ETH and use ETH to buy XRP before buying BTC back for XRP. Doing so will help capitalize on the arbitrage opportunities, and one ends with more BTC at the end of the process.

DeFi Arbitrage

DeFi arbitrage is another area where Mosdex excels. The Mosdex platform uses a blockchain-based algorithm that creates arbitrage opportunities for DEXs. A DEX or an automated market maker is a platform that does not rely on a third party to complete transactions.

Using complex algos, Mosdex discovers the price of crypto trading pairs using smart contracts. If it finds significant price differences on different DEXs, and centralized exchanges, Mosdex initiates cross-exchange trades. These trades exchange crypto from central exchanges and decentralized exchanges, benefiting traders.

Staking-Based Arbitrage

Mosdex operates a crypto-staking protocol that is powered by a proprietary profit-sharing model. The goal is to maximize yields via yield arbitrage. Mosdex provides arbitrage opportunities via staked assets on the platform.

For instance, if A has ETH with a 5% p.a. yield when staked, he may swap it for BNB, which has a higher yield of 7.1% p.a. When he needs his ETH, A will have to swap his BNB for ETH. The result is he pockets a 2.1% increase in yield. Masodex’s profit-sharing model aims to pay the customer back with a higher return on their investment.

To achieve this, it relies on complex algorithms, which detect arbitrage opportunities for staked assets while reducing costs. It also eliminates delays and ensures liquidity issues are not a problem. Arbitrage staking also brings about the issues of blockchain’s carbon footprint. With staking, the carbon footprint is minimal compared to traditional proof-of-work blockchains that consume significantly less energy.

How Does Staking Work

Staking arbitrage is one of the features offered on Mosdex. Understanding how staking works is useful to help one maximize arbitrage-staking profits. Staking is a mechanism found on proof-of-work blockchains. It is used to secure a blockchain while giving holders a chance to benefit from their tokens.

Staking is integral to the proof of stake consensus mechanisms. Most people think of staking as a mechanism for locking up tokens to receive staking rewards. It is more than that.

With staking, validating nodes lock up coins, which can be randomly picked to create a block and get a reward. A node operator will huge amounts to stake has a higher chance of being picked. When successful, the node operator and stakers get rewards distributed to the pool’s validators.

Staking rewards are given since stakers serve a practical purpose. They use their tokens are collateral, which is used to validate new blocks. In simple terms, stakers provide security for a blockchain network when they put their tokens at risk by nominating them to a node operator. For their risk-taking, they get a reward proportional to the value they offer the network. Staking is a way to buy the blockchain’s security, ensuring a large, sustainable ecosystem.

How the Mosdex Arbitrage Engine Works

The Mosdex arbitrage engine is at the core of the Mosdex platform. It is what helps everyone make money from their crypto. To work, the engine goes through a cycle that helps it maximize profits.

When a trader initiates a trade, the engine scans and compares prices at various exchanges and platforms. The AI that powers the engine finds coins whose price has high volatility. It then begins buying tokens at the lowest price while selling them at the highest price immediately. The sales are automated and are executed in milliseconds.

At this speed, thousands of transactions can be completed in a minute. Any price fluctuation that could be of benefit to you is utilized. Once all trades are completed, the funds are unlocked. You can opt to withdraw them or go in for another trading session. The result is that your funds are compounding within seconds for as long as you wish to trade. Given the high volatility of the crypto markets, arbitrage opportunities are endless.

Expert knowledge of how crypto trading works is not needed to use Mosdex. All you need is to understand how to understand the simple user interface. From there, the funds will be sent to you like clockwork. The longer you stake, the more could make.

As a writer, Richard is an advocate of blockchain technology and cryptocurrency in general. He writes about all things from cryptography to economics, with a focus on how it applies to cryptocurrencies. He is also passionate about writing about topics such as decentralization, open-sourced software development, and copyright law.