Crypto trading has come a long way since Bitcoin first introduced the concept of decentralized digital money. By 2025, the industry has matured, regulations have evolved, and technological advancements such as AI-driven analytics have reshaped how people interact with the market. Still, a key question remains: Is crypto trading worth it today, or has the opportunity passed?

To answer this, it’s important to recognize how the landscape has changed—both for better and for worse.

Content

A More Mature, Yet More Competitive Market

In the early years, volatility and unpredictability created extraordinary profit opportunities. Traders who entered the market before 2020 often saw massive returns simply by holding major assets like Bitcoin, Ethereum, or early altcoins. By 2025, however, the market has grown significantly, and with maturity comes competition.

Institutional traders, high-frequency trading bots, and global funds now dominate much of the liquidity. This means that opportunities still exist, but they are harder to capture without experience, discipline, and realistic expectations. Retail traders can no longer rely on hype or pure momentum to find success.

Regulation Has Reduced Scams—But Not Eliminated Them

One of the most significant shifts in 2025 is the rise of global crypto regulation. Governments in North America, Europe, and parts of Asia have implemented clearer guidelines on exchange licensing, asset classification, and KYC requirements. As a result, well-known platforms have become more secure and user-friendly.

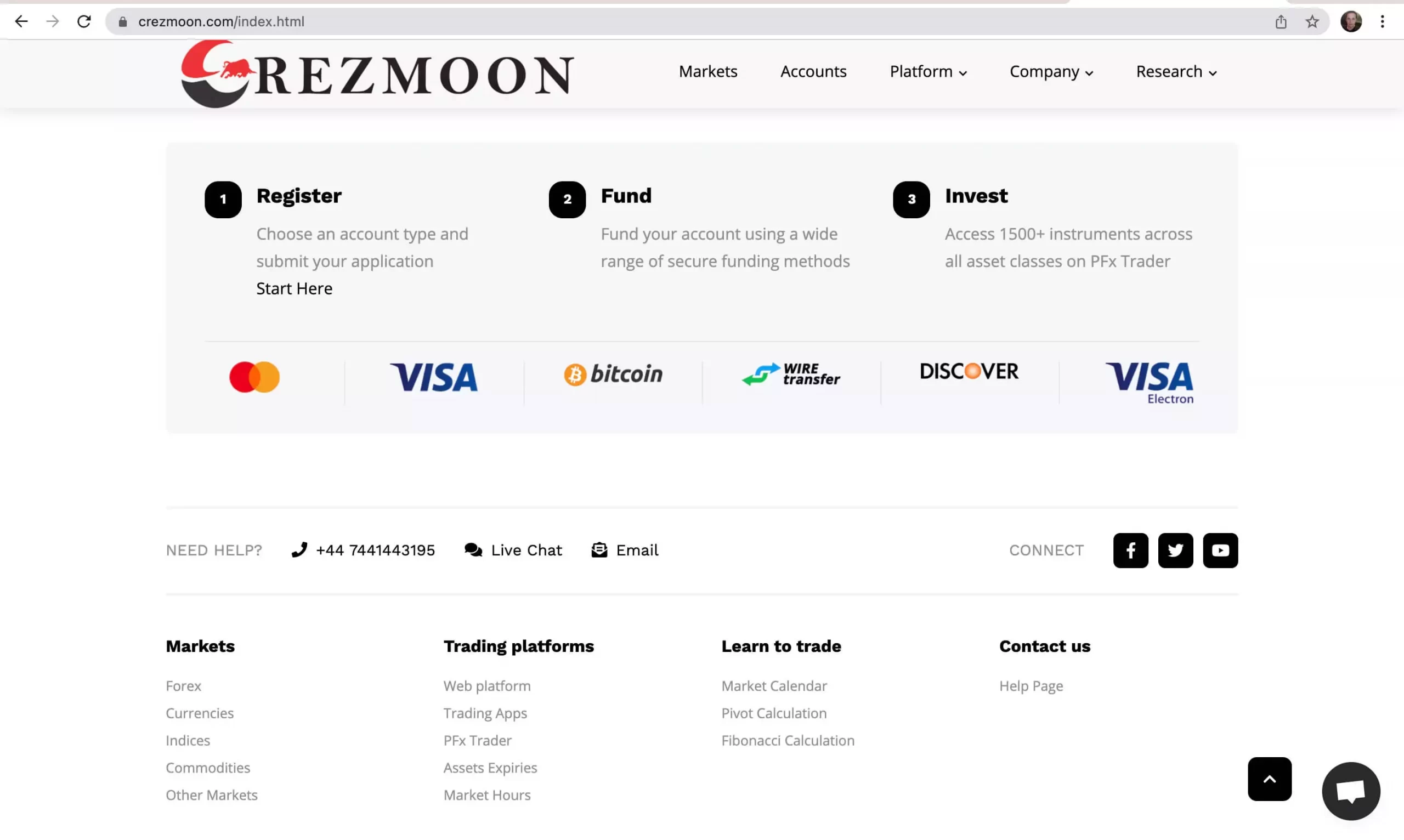

But this doesn’t mean the space is scam-free. New traders still encounter deceptive platforms that promise unrealistic returns or manipulate user withdrawals. For example, websites such as Axiom Trade appear online claiming to offer advanced trading tools, low fees, or automated profits. Platforms like these—especially when newly created, unregulated, or lacking transparent ownership—should always be approached with caution. Their presence is a reminder that due diligence remains essential for anyone considering crypto trading in 2025.

Volatility Still Creates Opportunity

Even though the market has matured, crypto remains far more volatile than traditional assets. This volatility is a double-edged sword. When used properly, it can create rapid profit opportunities, especially for short-term or swing traders. Bitcoin’s price can still move 5–10% within days, and mid-cap or low-cap tokens often experience even larger swings.

For traders who understand risk management, volatility is not something to fear—it’s a condition that enables gains. However, for inexperienced traders, volatility can lead to fast losses. Whether crypto is “worth it” in 2025 depends heavily on a person’s ability to tolerate and manage this instability.

Technology Has Improved Access and Analysis

One of the biggest advantages to trading crypto in 2025 is the availability of sophisticated tools that were once accessible only to professional traders. AI-assisted analysis, automated strategies, and real-time sentiment indicators are now integrated into many mainstream platforms.

These tools help traders:

- identify trends earlier

- automate their strategies

- diversify risk

- avoid emotional decision-making

But while helpful, these tools do not guarantee success. The crypto market is still influenced by global economic trends, regulatory announcements, and social sentiment—all of which can shift rapidly. Ultimately, technology supports traders, but it does not replace skill or education.

Long-Term Investing vs. Short-Term Trading

Another major factor in deciding if crypto trading is worth it depends on your approach.

Long-Term (“HODL”) Investors

Many long-term investors focus on established assets such as Bitcoin, Ethereum, and tokenized real-world assets. These tend to carry lower risk compared to trending altcoins. The long-term potential for blockchain adoption—especially in finance, identity, and supply chain—continues to give these assets value.

Short-Term Traders

Short-term traders seek to profit from daily or weekly price movements. While this approach can be profitable, it requires time, discipline, analysis, and a structured strategy. Many traders in 2025 use automated trading systems, but even these must be monitored closely.

So… Is Crypto Trading Still Worth It?

The answer depends on the individual:

Crypto Trading Is Worth It if:

- you have realistic expectations

- you educate yourself on market behavior

- you practice risk management

- you avoid unverified platforms and scams

- you trade with funds you can afford to lose

Crypto Trading Is Not Worth It if:

- you expect quick profits

- you fall for platforms offering guaranteed returns

- you are not comfortable with volatility

- you invest emotionally rather than analytically

Crypto trading remains an opportunity in 2025—but not an easy one. Those who treat it as a skill to learn rather than a gamble are more likely to see success. And most importantly, traders must remain vigilant. With platforms such as Axiom Trade and others appearing online, researching a platform’s legitimacy has become more important than ever.

In the end, crypto trading is still worth it—but only for those who approach it with caution, preparation, and a clear understanding of the risks.

As a writer, Richard is an advocate of blockchain technology and cryptocurrency in general. He writes about all things from cryptography to economics, with a focus on how it applies to cryptocurrencies. He is also passionate about writing about topics such as decentralization, open-sourced software development, and copyright law.